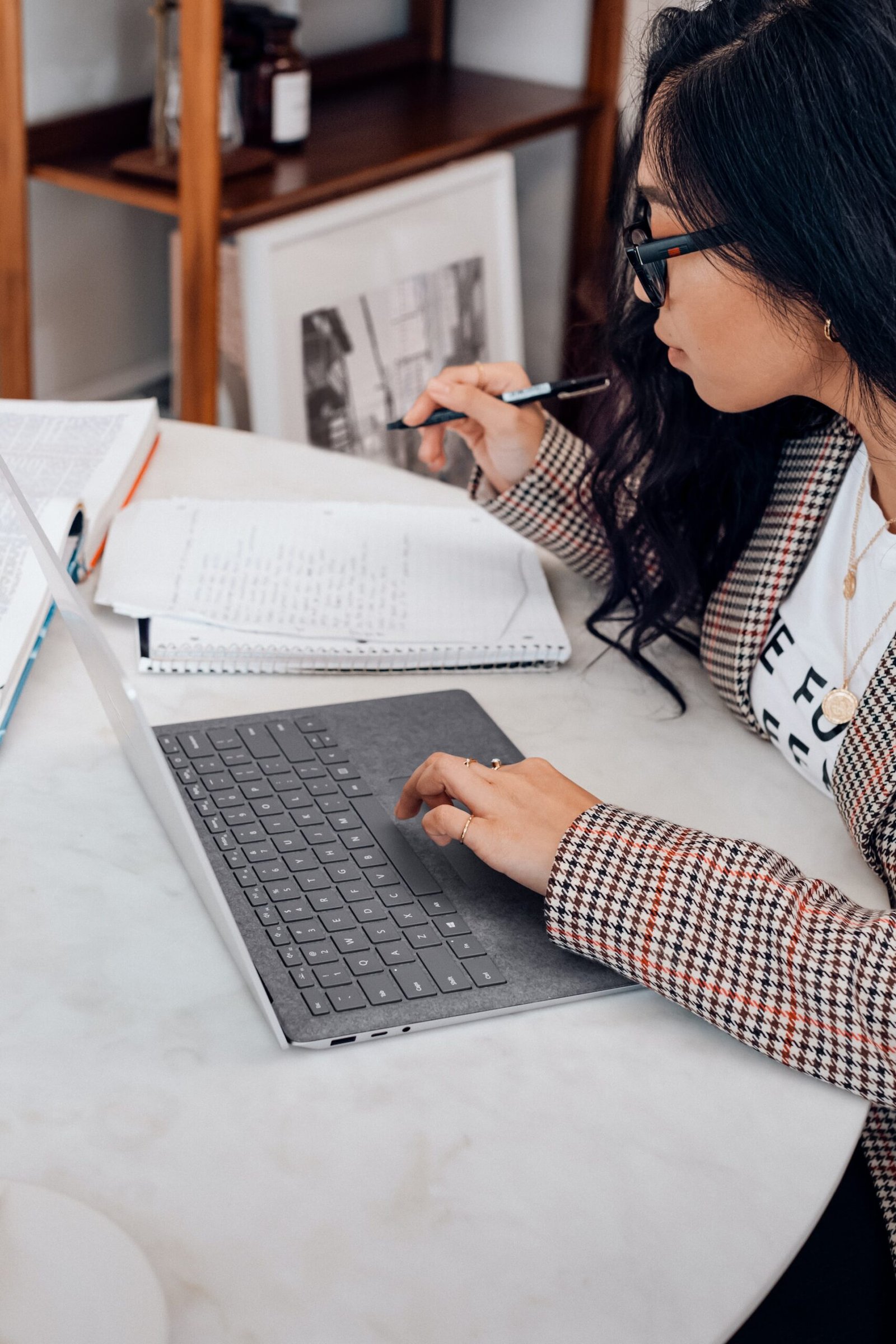

On this page, we discuss two financial obligations of a study loan. Studying can be expensive, and many students turn to loans to finance their education. A study loan is a form of financial aid that allows students to pay for their tuition fees, books, and living expenses while in school. However, when taking out a study loan, it is essential to understand the financial obligations that come with it. In this article, we will explore two significant financial obligations of a study loan.

Financial Obligations of a Study Loan

The two most common obligations of a study loan are the repayment of the loan, and interest rates. Let’s discuss these below:

Repayment of the Loan

One of the primary financial obligations of a study loan is repayment. Once a student completes their studies, they will have to start repaying the loan. The repayment of the loan includes the principal amount borrowed, as well as any interest that has accrued over the loan’s life.

Loan repayment typically begins after the student graduates or drops out of school. Some loans offer a grace period of a few months before the repayment starts. The repayment period for study loans can vary, but it usually lasts between ten to twenty years, depending on the type of loan and the borrower’s financial situation.

There are several ways to repay a study loan. Some loans require borrowers to make fixed monthly payments over the loan’s life, while others offer flexible repayment plans based on the borrower’s income. Borrowers can also choose to pay off the loan faster than the required payments, which will reduce the overall interest paid on the loan.

Interest Rates

Interest rates are another significant financial obligation of a study loan. Interest rates on study loans can vary based on several factors, such as the type of loan, the lender, and the borrower’s credit score. Typically, loans with fixed interest rates remain the same throughout the loan’s life, while loans with variable interest rates can fluctuate based on market conditions.

The interest rate on a study loan can significantly impact the overall cost of borrowing. A higher interest rate can result in the borrower paying more in interest over the loan’s life, increasing the total cost of the loan. It is essential to compare interest rates from different lenders before choosing a loan to ensure the best possible rate.

Video: How To Apply For A Nedbank Student Loan

A study loan can help students finance their education, but it comes with significant financial obligations. Repayment of the loan and interest rates are two critical financial obligations of a study loan that borrowers need to understand. Borrowers should research the various loan options available and carefully read the loan agreement before signing to ensure they can meet their financial obligations and avoid defaulting on the loan. By understanding the financial obligations of a study loan, students can make informed decisions about how to finance their education while minimizing debt and financial stress.