On this page, you will find a list of Grade 11 Accounting fixed assets questions and answers based on the previous question papers from exams.

Grade 11 fixed assets questions are part of the paper 1 Accounting exam paper.

2024 November Grade 11 Accounting Fixed Assets Questions and Answers

Below is a list of questions and answers based on the 2024 November Accounting Grade 11 fixed assets section:

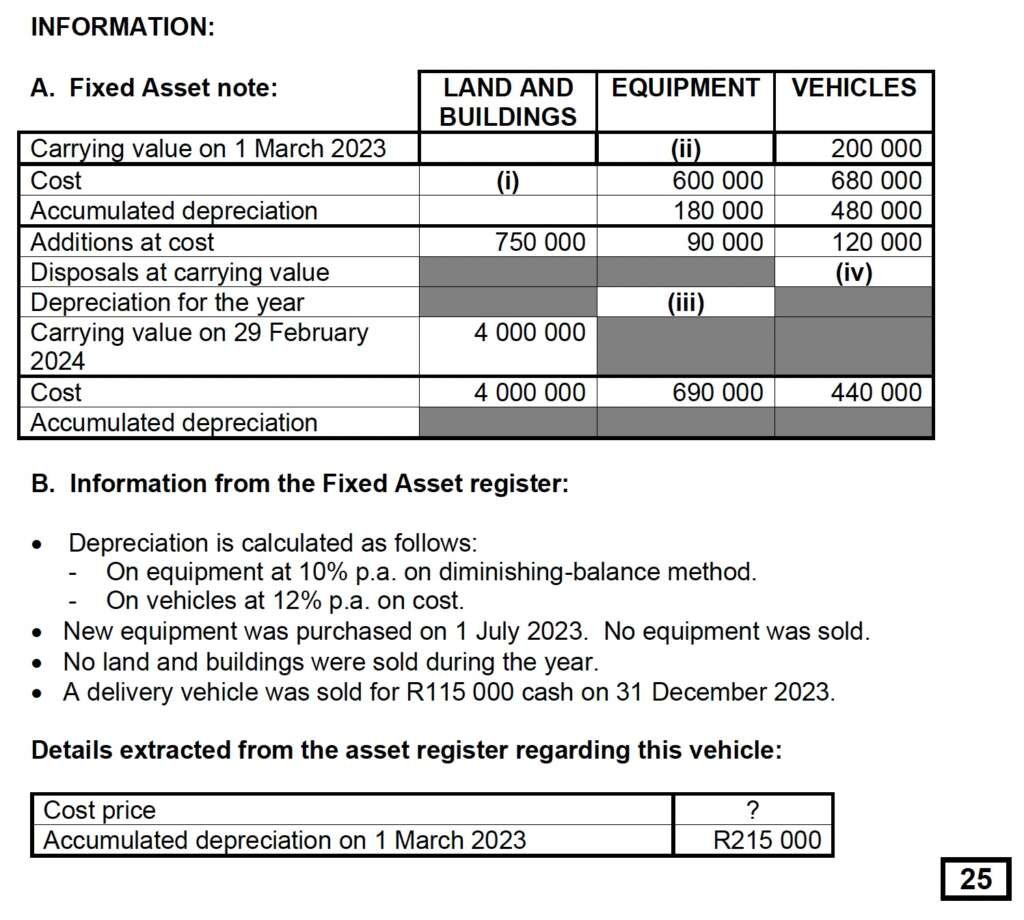

The following information relates to Asande Traders for the year ended 29 February 2024.

1.1 Calculate the missing figures labelled (i) to (iv) in the Fixed Asset Note. (12 marks)

Answer:

1.2 Prepare the Asset Disposal Account based on the given information. (7 marks)

Answer:

1.3 Determine the percentage increase in the value of Land and Buildings, given that their market value as of 29 February 2024 is R5 500 000. (4 marks)

Answer:

1.4 The business owner has observed that the mileage on one of the vehicles is unusually high and suspects that the driver is misusing the vehicle. Suggest TWO internal control measures that can help prevent the misuse of company vehicles.

Answer:

- Signing in and out of vehicles to track where they are and who used them / putting tracking devices on the vehicles / have a log book to record the movement on vehicles.

- Have a policy on what time should the vehicles be returned on business premises / lock them on business premises at night

2023 November Grade 11 Accounting Fixed Assets Questions and Answers

1.2 FIXED (TANGIBLE) ASSETS

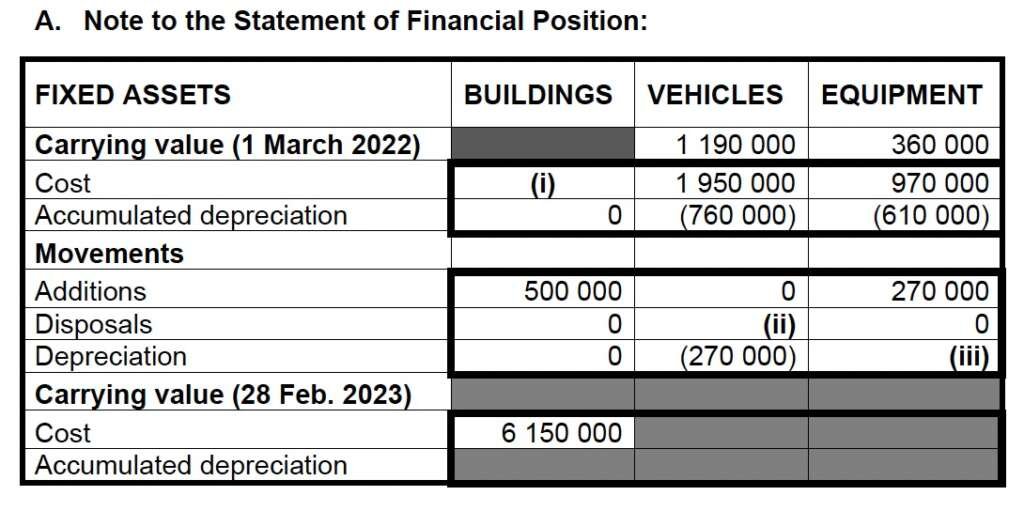

The following information relates to SANDI BROTHERS for the financial year ended 28 February 2023.

REQUIRED:

Calculate the missing figures labeled (i) to (iii) in the Fixed Asset Note. (12 marks)

INFORMATION:

Note to the Statement of Financial Position:

B. Additional Information

- Depreciation is calculated as follows:

- Equipment: 10% per annum on carrying value.

- Vehicles: 15% per annum on cost.

- During the financial year, extensions were completed on the buildings.

- An old vehicle (original cost: R300 000) was sold at carrying value on 31 August 2022. The accumulated depreciation on this vehicle was R240 000 as of 1 March 2022.

- New equipment was purchased on 1 November 2022.

Answer: