Understanding the difference between the repo rate and the prime rate is essential for anyone with an interest in South Africa’s economy or financial markets. These two rates are among the most important economic indicators, impacting a wide range of activities, from personal loans and mortgages to the overall health of the national economy. In this article, we will delve into the intricacies of these two rates and explore how they affect South African consumers and businesses.

Difference between Repo rate and prime rate in south africa

Repo Rate: Definition and Implications

The repo rate, or repurchase rate, is the interest rate at which the South African Reserve Bank (SARB) lends money to commercial banks in the country. It is a critical tool that SARB uses to manage inflation and stabilize the economy. By adjusting the repo rate, SARB can influence the cost of borrowing for banks, which in turn affects the interest rates they charge their customers.

When SARB increases the repo rate, it becomes more expensive for banks to borrow money, resulting in higher interest rates for customers. This typically leads to a decrease in consumer and business spending, which can help curb inflation. Conversely, a decrease in the repo rate makes borrowing cheaper for banks, lowering interest rates for consumers and businesses, and potentially stimulating spending and economic growth.

Prime Rate: Definition and Implications

The prime rate, on the other hand, is the interest rate charged by commercial banks to their most creditworthy customers, usually large corporations and high-net-worth individuals. In South Africa, the prime rate is often used as a benchmark for various types of loans, such as mortgages, personal loans,

and car loans. While the prime rate is set by individual banks, it is usually closely tied to the repo rate, as changes in the latter have a direct impact on the cost of borrowing for banks.

When the repo rate changes, banks typically adjust their prime rates accordingly. For instance, if the repo rate goes up, the cost of borrowing for banks increases, leading them to raise their prime rate to maintain profitability. As a result, loans become more expensive for customers, potentially reducing borrowing and spending.

Conversely, if the repo rate decreases, banks can lower their prime rates, making loans more affordable for consumers and businesses. This can lead to increased borrowing, spending, and investment, ultimately stimulating economic growth.

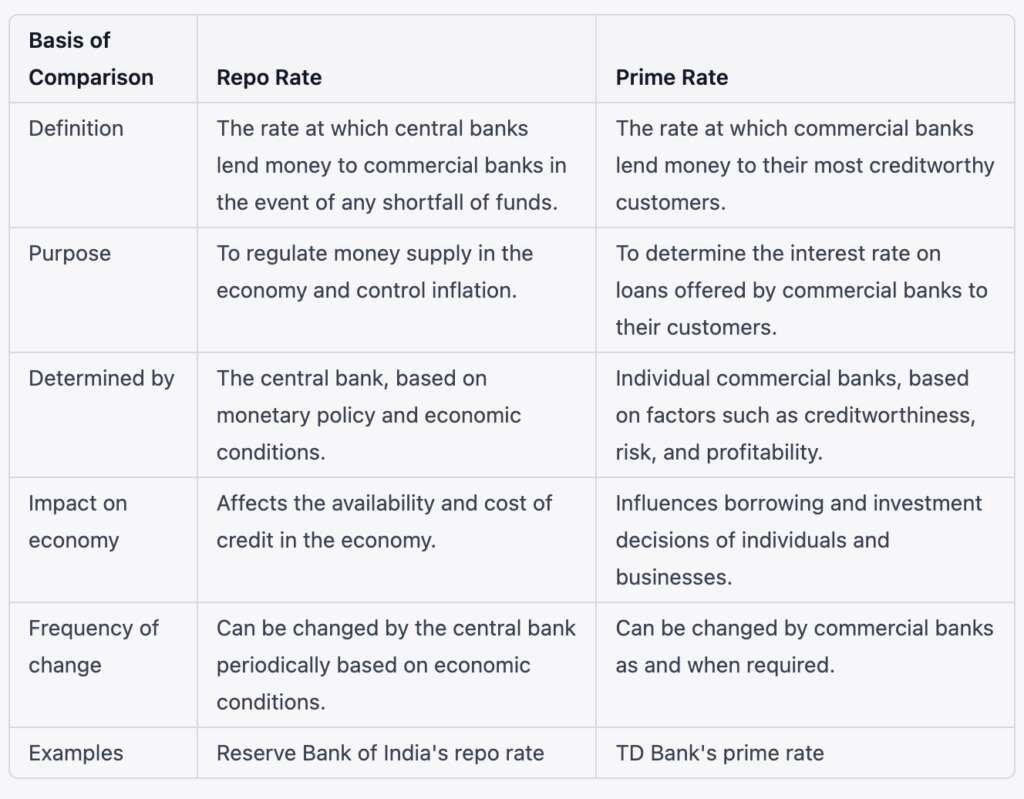

Overview of Differences in Table Format

The Relationship Between Repo Rate and Prime Rate in South Africa

In South Africa, the prime rate is typically set at a fixed percentage above the repo rate, generally 3.5%. This means that when the repo rate changes, the prime rate moves in tandem. For example, if the repo rate is set at 4%, the prime rate would be 7.5% (4% + 3.5%).

The close relationship between these two rates means that changes in the repo rate have a direct impact on the prime rate and, by extension, the cost of borrowing for consumers and businesses in South Africa. As such, closely monitoring changes in these rates can help individuals and businesses make informed decisions about borrowing and financial planning.

Conclusion

Understanding the difference between the repo rate and the prime rate in South Africa is crucial for both consumers and businesses. As key indicators of the cost of borrowing, these rates play a significant role in shaping the country’s economic landscape. By keeping a close eye on changes in these rates, individuals and businesses can better navigate the financial market and make informed decisions about loans, investments, and spending.

While the repo rate serves as a critical tool for the South African Reserve Bank to manage inflation and stabilize the economy, the prime rate reflects the cost of borrowing for creditworthy customers. As the repo rate directly influences the prime rate, any changes can have a ripple effect on various aspects of the economy, such as consumer spending, business investment, and overall economic growth.

Just to summarise, the repo rate and prime rate are intricately linked, and understanding their relationship is essential for anyone with an interest in South Africa’s financial markets. By monitoring these rates and making sound financial decisions accordingly, consumers and businesses can effectively navigate the ever-changing economic landscape and work towards a more stable and prosperous future.