Determining Employee Salary : Notes, Common Exam Questions and Answers Guide, Online Quizzes and Activities for Business Studies Grade 12 Revision Studies, from Human Resources Function section. This content is under Term 1 as per the CAPS Curriculum.

On this page, grade 12 students learn and study for revision using REAL EXAM questions based on Determining Employee Salary topic, using activities and engaging quizzes. Every South African grade 12 learner who wants to pass Business Studies subject with a distinction, needs to go through the valuable study resources on this page.

Determining Employee Salary Business Studies Grade 12

Determining employee salary is a critical task for any organization, as it ensures that employees are fairly compensated for their work and helps to attract and retain talented employees.

Important Keywords you should know

Here are some important keywords related to salary determination in South Africa:

- Minimum Wage: The lowest wage that employers are legally required to pay employees for their work. The minimum wage is set by the government and varies depending on the industry and type of work.

- Collective Bargaining: The process of negotiations between employers and employee representatives, such as unions, to determine terms and conditions of employment, including salary.

- Cost of Living: The amount of money needed to sustain a certain standard of living, which includes basic necessities such as housing, food, and healthcare.

- Living Wage: The minimum wage that allows employees to meet their basic needs and maintain a reasonable standard of living.

- Market-related Salary: A salary that is based on the market value of the employee’s skills, experience, and job role. It is determined by comparing the employee’s salary to similar job roles in the same industry.

- Performance-based Pay: A pay structure that rewards employees based on their performance and contributions to the organization. It is often used to motivate employees to perform at their best.

- Salary Survey: A survey of salary data within an industry or job market to determine the average salary for a particular job role or experience level.

- Salary Structure: A framework for determining employee salaries based on factors such as job role, experience, and performance. It outlines the salary range for each job role and provides guidelines for salary increases and promotions.

- Total Cost to Company (TCTC): The total amount that the company pays for an employee’s salary, benefits, and other expenses related to employment.

Understanding these keywords can help employers and employees in South Africa to navigate the complex process of determining and negotiating salaries.

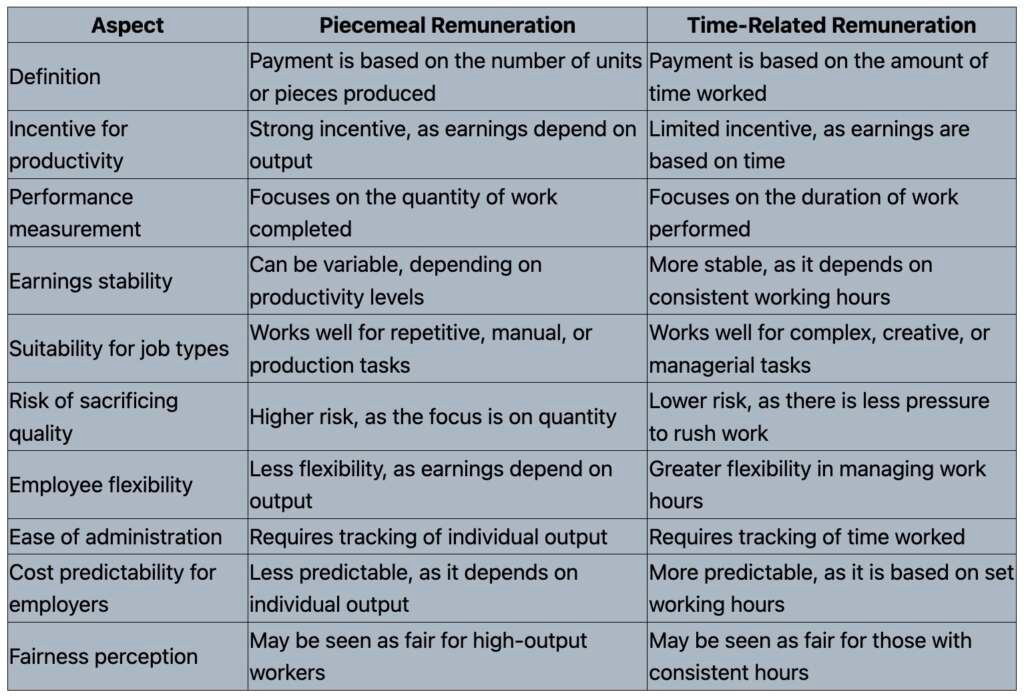

Differences between piecemeal and time-related remuneration

The link between salary determination and the Basic Conditions of Employment Act

The Basic Conditions of Employment Act (BCEA) is a South African labor law that outlines the minimum employment conditions for workers, including hours of work, overtime pay, leave, and remuneration. The act establishes a legal framework for salary determination and requires employers to comply with certain standards when determining employee salaries. Here are some ways in which salary determination is linked to the BCEA:

- Minimum Wage: The BCEA sets a national minimum wage, which is the lowest wage that employers can legally pay employees. Employers must ensure that their employees are paid at least the minimum wage, regardless of the type of remuneration.

- Overtime Pay: The BCEA requires employers to pay employees for any overtime worked, at a rate of at least one and a half times the employee’s normal wage. Employers must also ensure that their employees do not work more than the maximum number of hours per week set by the BCEA.

- Deductions: The BCEA sets limits on the deductions that employers can make from employee salaries, such as for pension contributions or union fees.

- Equal Pay: The BCEA prohibits discrimination in remuneration on the basis of race, gender, or any other arbitrary grounds. Employers must ensure that employees are paid equally for work of equal value.

- Record-Keeping: The BCEA requires employers to keep accurate records of employee salaries, including hours worked, overtime pay, and any deductions made.

Compliance with the BCEA is essential for employers when determining employee salaries, as failure to comply can result in penalties and legal action. Employers must ensure that their salary determination processes are in line with the requirements of the BCEA to ensure fair and lawful remuneration for their employees.

Salary Administration

Salary administration refers to the process of determining, implementing, and maintaining an organization’s salary structure and compensation plans for employees. It involves setting and adjusting employee salaries and benefits in accordance with the organization’s compensation policies and industry standards.

Deductions

Here are some deductions that may be made from employee salaries and who is responsible for each deduction in a table format:

List of Applicable Deductions

Here is a list of common deductions that may be made from employee salaries:

- Taxes: Federal and state taxes, including income tax and Social Security tax, are deducted from employee salaries.

- Retirement Plans: Contributions to retirement plans, such as 401(k) or pension plans, may be deducted from employee salaries.

- Health Insurance: Premiums for employer-sponsored health insurance plans may be deducted from employee salaries.

- Life Insurance: Premiums for employer-sponsored life insurance plans may be deducted from employee salaries.

- Union Dues: Membership fees for labor unions may be deducted from employee salaries if the employee is a member of the union.

- Wage Garnishments: Court-ordered wage garnishments, such as child support payments or unpaid debts, may be deducted from employee salaries.

- Loans: Deductions may be made from employee salaries to repay loans made by the employer or other third-party lenders.

- Savings Plans: Deductions may be made from employee salaries to contribute to savings plans, such as Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs).

- Uniforms or Equipment: The cost of uniforms or equipment required for the job may be deducted from employee salaries.

It is important for employers to comply with relevant laws and regulations when making deductions from employee salaries. Employers must also provide employees with clear information about any deductions made from their salaries, including the reason for the deduction and the amount deducted.

Examples of Employee Tax and UIF

Employee Tax and UIF (Unemployment Insurance Fund) are both statutory deductions made from an employee’s salary in South Africa. Here is an explanation of these deductions and how they are calculated:

Employee Tax (PAYE):

Employee tax, also known as Pay-As-You-Earn (PAYE), is a tax that employers deduct from employee salaries on behalf of the South African Revenue Service (SARS). The amount of tax deducted is based on the employee’s gross salary, as well as any deductions or exemptions they are entitled to.

The tax calculation takes into account the employee’s tax bracket, which is determined by their annual salary. For the 2022 tax year (1 March 2021 to 28 February 2022), the tax brackets and rates are as follows:

- Up to R216,200: 18% of taxable income

- R216,201 to R337,800: R38,916 plus 26% of taxable income above R216,200

- R337,801 to R467,500: R70,532 plus 31% of taxable income above R337,800

- R467,501 to R613,600: R110,739 plus 36% of taxable income above R467,500

- R613,601 to R782,200: R163,335 plus 39% of taxable income above R613,600

- R782,201 and above: R229,089 plus 41% of taxable income above R782,200

For example, an employee earning a gross salary of R300,000 would be in the third tax bracket. Their taxable income would be R83,200 (R300,000 minus R216,200), and their tax would be R19,919.52 (R70,532 plus 31% of R83,200).

UIF:

The Unemployment Insurance Fund (UIF) is a compulsory fund that provides short-term relief to workers who are unemployed or unable to work due to illness or maternity leave. Employers are required to deduct 1% of their employees’ gross salaries and contribute an additional 1% on behalf of the employee to the UIF.

For example, if an employee earns a gross salary of R20,000 per month, their UIF contribution would be R200 (1% of R20,000) and the employer would contribute an additional R200 on their behalf.

Employee tax and UIF are two statutory deductions made from an employee’s salary in South Africa. Employee tax is based on the employee’s gross salary and tax bracket, while UIF is a fixed percentage of the employee’s gross salary. These deductions are important for funding government services and providing social welfare support to workers.

Understanding Differences between Net Salary and Gross Salary

Gross salary and net salary are both terms used to describe an employee’s earnings, but they represent different amounts. Here is an explanation of the differences between gross salary and net salary:

- Gross Salary: Gross salary is the total amount of money earned by an employee before any deductions or taxes are made. This includes all forms of remuneration, such as basic salary, bonuses, overtime pay, and allowances.

For example, if an employee has a basic salary of R15,000 per month and receives a R5,000 bonus, their gross salary for that month would be R20,000.

- Net Salary: Net salary is the amount of money that an employee takes home after all deductions and taxes have been made from their gross salary. This is the amount that appears in an employee’s bank account at the end of each pay period.

Deductions from gross salary include:

- Employee tax (PAYE)

- Unemployment Insurance Fund (UIF)

- Medical aid contributions

- Retirement fund contributions

- Other statutory deductions, such as skills development levies or employee benefits

The net salary is calculated by subtracting these deductions from the gross salary.

For example, if an employee’s gross salary is R20,000 and their total deductions for that month are R5,000, their net salary for that month would be R15,000.

In summary, gross salary refers to the total amount earned by an employee before any deductions or taxes, while net salary is the amount of money that an employee takes home after all deductions and taxes have been made. It is important for employees to understand the difference between gross and net salary to effectively manage their personal finances and plan for their future.

Fringe Benefits

Fringe benefits, also known as employee benefits, are non-salary compensations that employers provide to their employees in addition to their regular pay. These benefits can be monetary or non-monetary and are designed to attract and retain employees, improve their job satisfaction and motivation, and enhance their overall well-being.

Here are some common examples of fringe benefits that are applicable in South Africa:

- Medical Aid: Employers may provide their employees with medical aid as part of their employee benefits package. This covers the cost of medical expenses, including doctor’s visits, hospitalization, and prescription medication.

- Retirement Funds: Employers may offer retirement funds, such as pension or provident funds, to employees to help them save for their future.

- Life Insurance: Employers may provide life insurance coverage to employees as part of their fringe benefits package. This ensures that the employee’s beneficiaries receive a payout in the event of the employee’s death.

- Education Assistance: Some employers provide education assistance to their employees to help them further their education or develop new skills.

- Car Allowance: Employers may provide a car allowance to employees who need to use their personal vehicles for work purposes.

- Cellphone Allowance: Employers may provide a cellphone allowance to employees who need to use their personal phones for work purposes.

- Housing Allowance: Employers may provide a housing allowance to employees who need to live close to their place of work or in expensive areas.

- Travel Allowance: Employers may provide a travel allowance to employees who need to travel for work purposes.

Fringe benefits are an important part of an employee’s compensation package and can have a significant impact on their job satisfaction and retention. It is important for employers to offer a range of benefits that meet the needs of their employees and are aligned with their overall compensation strategy.

Advantages and Disadvantages of Fringe Benefits

Here is a table format with the advantages and disadvantages of fringe benefits to businesses:

Advantages and Disadvantages of Fringe Benefits to a Business:

| Advantages | Disadvantages |

|---|---|

| Increased Employee Satisfaction | Additional Costs |

| Improved Retention and Reduced Turnover | Complexity in Administration |

| Enhanced Recruitment Appeal | Potential for Perceived Inequality |

| Increased Productivity | Tax Implications |

| Healthier and Happier Employees | Difficulty in Choosing Appropriate Benefits |

Examples of Advantages:

- Increased Employee Satisfaction: Providing employees with benefits such as health insurance, retirement plans, and paid time off can boost their job satisfaction, making them more committed to the company.

- Improved Retention and Reduced Turnover: Fringe benefits can help retain valuable employees, reducing the costs and disruptions associated with high turnover rates.

- Enhanced Recruitment Appeal: A competitive benefits package can help attract top talent to the company, giving the business an edge over competitors.

- Increased Productivity: Benefits like flexible work schedules or wellness programs can lead to healthier, more focused employees, which can translate into increased productivity.

- Healthier and Happier Employees: Benefits such as gym memberships or mental health support can promote overall employee well-being, resulting in a more positive work environment.

Examples of Disadvantages:

- Additional Costs: Offering fringe benefits can be expensive for a company, particularly for small businesses with limited budgets.

- Complexity in Administration: Managing a variety of fringe benefits can be time-consuming and complicated, requiring additional resources and expertise.

- Potential for Perceived Inequality: If certain benefits are only available to specific employees or departments, it may create perceptions of inequality and discontent among the workforce.

- Tax Implications: Some fringe benefits are taxable, which can complicate tax reporting and compliance for both the company and the employees.

- Difficulty in Choosing Appropriate Benefits: Determining which fringe benefits will be most appealing and beneficial to employees can be challenging, and the wrong choice may result in wasted resources or reduced employee satisfaction.

While offering fringe benefits can have many advantages for businesses, such as attracting and retaining employees, motivating and improving morale, and providing tax advantages, there are also potential disadvantages, such as the cost and administrative burden, perceptions of unfairness, and the potential for abuse. It is important for businesses to carefully consider the pros and cons of offering fringe benefits and to ensure that they align with their overall compensation strategy and business objectives.